Ultimate Guide to Insurance Cloud Computing in 2024

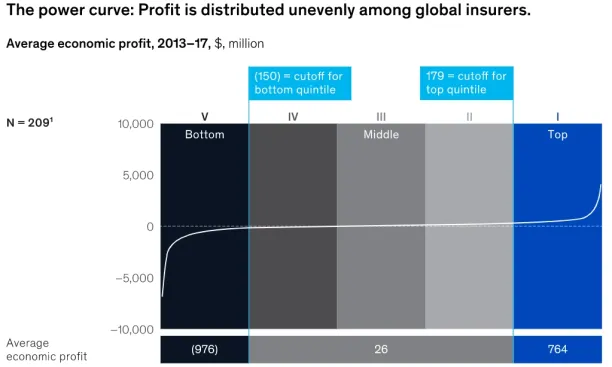

The insurance sector has transformed rapidly in recent years, changing the rules of competition. Fierce competition within the mature sector is forcing profit rates to low levels. Companies that find low-cost and effective solutions for adopting new technologies are ahead in this competition.

Insurance cloud computing solutions may offer insurers a simple route to digital transformation. However, the challenge is many insurers have a lack of information concerning insurance cloud solutions. To close the gap in this article, we introduce benefits, applications, challenges and providers of cloud computing for insurance.

What is insurance cloud computing?

Insurance cloud computing is an easy way of performing digital transformation for insurance companies. For a monthly membership charge, third-party software providers—mostly insurtech firms—let insurance companies use their software.

Insurance companies merely require an internet connection and pay a subscription fee to access cloud computing solutions. A metaphor of cloud computing is staying at a hotel: Even though customers do not own the hotel room, they can stay there, use the restaurant, pool etc within the booking period. Same logic is applied for cloud solutions.

Insurance cloud computing solutions are designed for the specific needs of insurers such as:

- Claims management

- Underwriting

- API integration etc.

What are the benefits of using cloud computing on insurance practices?

Cloud services help insurance companies save money, improve underwriting, claims processing, fraud prevention, customer service and business operations.

Cloud computing means that without developing or purchasing a hardware component, one can use some services such as computing, business processes, data storage, databases, software development, etc. on a pay-per-use basis.

The services which are provided by clouds provide the following benefits:

- Cost effective solution: Since there is no need to build a hardware system it is cost friendly.

- Modernization of core insurance processes: Optimization or automation of underwriting, claims adjustment, first notice of loss and claims processing.

- Better insight into business processes: More effective fraud analysis, easier analysis of financial performance and compliance, etc.

- Better customer relationships: By interpreting data, customer requirements can be better understood.

- Standardization of processes: Worldwide access to clouds is possible anytime and anywhere. Therefore, cloud computing brings ease of doing business.

What is the level of interest in cloud computing within the insurance sector?

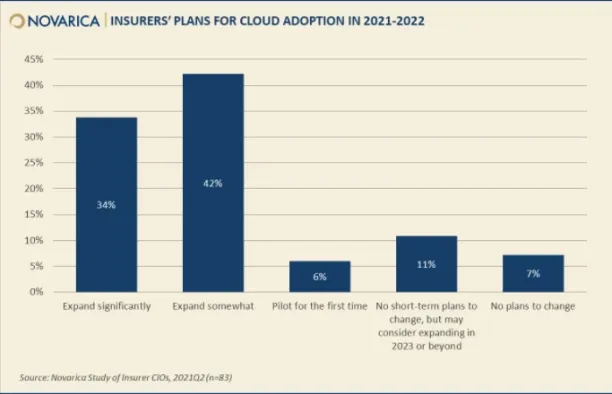

According to Novarica, more than 90% of insurance companies were using cloud computing for their business processes as of June 2021. The percentage has increased rapidly in recent years and, as shown in the chart below, 82% of companies intended to continue investing in cloud solutions to some extent by 2022. The study also concludes that cloud strategies are primarily driven by the flexibility requirements of the sector. Deloitte’s report also confirms this assertion, in which they describe “speed” as the new currency in the insurance sector.

What are the use cases of cloud computing for insurance practices?

Cloud computing is a beneficial tool for insurance practices in areas like:

- Analytics

- Introducing system modernization (business flexibility)

- Data storage

- Cost reduction

Analytics

Analytics is one of the most important services that insurance firms can benefit from cloud computing. Analytics increases efficiency in processes like: Underwriting and risk assessment, fraud detection and assessing customer satisfaction. Easy access and use of analytics on cloud services make them convenient tools for insurance companies.

Introducing system modernization (business flexibility)

Compared to most IT processes, the introduction of cloud services requires little time and effort. Moreover, cloud systems are integration-friendly processes. In most cases, a few mouse clicks are all it takes to initiate them. Effortless sharing of company information and 24/7 access to documents are factors that increase business flexibility. Insurance cloud services can:

- Automate claims processing

- Automate document management

- Provide an omnichannel customer service for insurers

Integrate with CRM and ERP systems.

To learn more you can read our insurance as a service article.

Data storage

Cloud services offer their customers different data storage packages, which provide different security measures for data. Nevertheless, cloud computing services offer relatively costless data archiving.

Note that the security of external data can be problematic, especially for insurance companies. In this context, storing different data in archive, nearline, coldline or standard storage clusters, depending on their sensitivity, can ensure data security. It is also important to remember that different storage clusters have different costs. Therefore, to optimize cloud costs, not all data should be stored in the archive unless it is sensitive information.

Cost reduction

Using cloud computing optimizes costs in two ways:

- Cloud computing reduces capital expenditure since there is no need to set up an in-house server.

- Cloud computing indirectly lowers costs by automating many of the insurance practices mentioned above and making them more efficient.

What are the challenges of using cloud computing in insurance practice?

By outsourcing IT services insurance companies may face the following risks:

- Insurance companies may have issues with the availability of the cloud services they purchase. The cloud provider’s servers may be insufficient or far from the insurance company’s location. In addition, the cloud provider’s servers might be powerful enough but shut down for certain reasons, which could negatively affect a firm’s use of cloud computing services.

- Privacy protection and control over data can be problematic when using cloud computing services. Especially with public clouds, data security is not sufficiently protected compared to private clouds.

- There is a risk of data loss while uploading a massive amount of data.

Determine the business requirements your company needs from a cloud service. Different cloud providers have some weaknesses and strengths to supply features such as:

- Computing power

- Responsiveness

- Storage area

- And reliability of the cloud service.

Therefore, it is critical to pick vendors wisely.

Top 7 insurance cloud computing software

The table below shows 7 insurance cloud computing solution providers that aim to improve different insurance practices. While we determining companies we have used ratings from our following lists:

Note: Keep in mind that the firms are sorted alphabetically. Ratings range from 0 to 5.

Table 1: Top 7 insurance cloud computing software.

| Provider | Rating | Focus area |

|---|---|---|

| Applied Epic | 4.3 | Accounting, customer service, document management |

| BriteCore | 4.1 | Underwriting & claims processing |

| NextAgency for Health & Life Insurance | 4.8 | Agency management |

| RiskMatch | 5 | Risk assessment |

| Speedy Claims | 4.7 | Claims processing |

| Virtual Claims Adjuster | 4.8 | Claims processing |

| [VRS]™ Virtual Risk Space | 5 | Underwriting & FNOL |

Further readings

You can check our other articles on the use of digital technologies in the insurance sector:

- Insurance Pricing: Its Importance, Determination & New Methods: Both commercial and property insurance customers are quite price sensitive. Therefore, it is important for insurers to understand the new technologies that improve their operational efficiency.

- Impact of the Low/No-Code Platforms on the Insurance Sector: As with cloud platforms, no/low code platforms help insurers initiate faster digital transformation by eliminating the need for code writing skills.

- 6 Ways IoT will Change the Insurance Sector: According to our analysis, the Internet of Things (IoT) will be the most effective technology that will completely change insurance practices. Thanks to smart devices, insurance will soon become assurance that is no longer about compensating a loss, but about preventing it.

If you need help improving your insurance operations, we can find insurtechs.

Cem is the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per Similarweb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised enterprises on their technology decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

Sources:

AIMultiple.com Traffic Analytics, Ranking & Audience, Similarweb.

Why Microsoft, IBM, and Google Are Ramping up Efforts on AI Ethics, Business Insider.

Microsoft invests $1 billion in OpenAI to pursue artificial intelligence that’s smarter than we are, Washington Post.

Data management barriers to AI success, Deloitte.

Empowering AI Leadership: AI C-Suite Toolkit, World Economic Forum.

Science, Research and Innovation Performance of the EU, European Commission.

Public-sector digitization: The trillion-dollar challenge, McKinsey & Company.

Hypatos gets $11.8M for a deep learning approach to document processing, TechCrunch.

We got an exclusive look at the pitch deck AI startup Hypatos used to raise $11 million, Business Insider.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow on

Comments

Your email address will not be published. All fields are required.