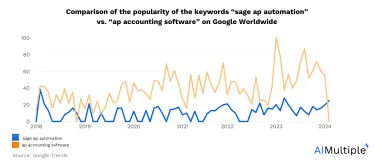

SAGE AP Automation '24: 7 Software & 250 Reviews Analyzed

Automating AP processes is a crucial phase for autonomous finance. Sage offers accounts payable automation in:

- invoice and payments processing

- receiving & tracking invoices

- management of the invoice approval process & more.

ERP vendors like Sage provide all-in-one suite and single source for important details like financials, inventory and vendor data. While Sage offers an AP solution, businesses can procure add-ons such as Pairsoft that can improve document management & financial workflows.

Explore Sage’s AP automation solutions, their capabilities, shortcomings with ways to overcome them, and case studies.

7 Software for SAGE AP automation

| Vendor* | Prominent Capabilities | Starting price |

|---|---|---|

| Sage Intacct | -Extract data from AP bills -Set spending limits -Auto reconciliation of transactions | Not publicly shared |

| Sage 50 | -Cash flow & invoice customization -Inventory management tools | $59/user per month** |

| PaperSave by Pairsoft | -Document Capture -Data extraction -Validation -Approval -Send Files to Sage Intacct | Not publicly shared |

| Tipalti | -Supplier onboarding -IRS & VAT validations -OFAC screening -Payment reconciliation & AP reporting with Sage Intacct | $149/month |

| Stampli | -Multi-subsidiary support -Stampli card (virtual & physical) -Customer on-boarding -Expense management tools | Not publicly shared |

| Quadient Accounts Payable by Beanworks | -Line item data capture -Real-time dashboards -Search invoices by GL code | Volume based |

| Bill | -Workflow customization -Audit trails -Two-layer approvals | Not publicly shared |

*The first two products belong to SAGE. Remaining products are AP solutions that integrates with SAGE.

**For more on SAGE 50 pricing, check the ”Pricing” section below.

See the capabilities, pros and cons of these vendors based on user experience. SAGE’s own products are analyzed below.

Sage AP automation overview

41% of companies plan to make their invoice payment process automated and 71% of the people in charge of invoices think that smart systems are very important for making the AP process better.1

In AP automation, Sage offers two solutions: Sage Intacct and Sage 50 cloud.

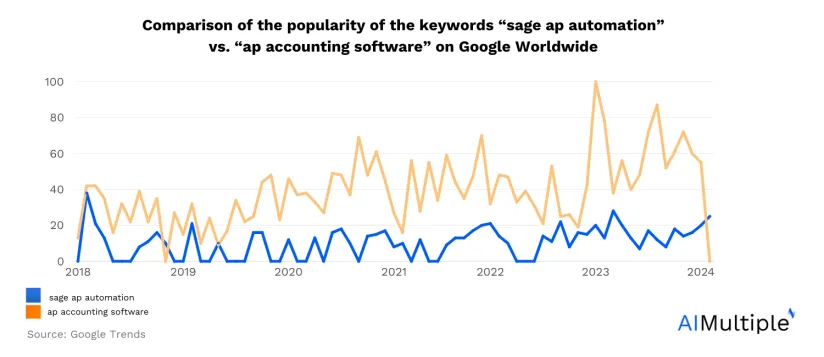

Sage 50

Sage 50 is a software focused on the needs of small businesses and accountants. It has 5 major capabilities:

- cash flow and invoicing (Figure 2), which:

- allows customization of views by date or transaction types (invoices & more)

- enables sending invoices to multiple customers at once

- payments and banking

- inventory management

- job and project costing

- reporting

Figure 2: Sage 50 cash flow and invoicing dashboard.2

Sage 50 also offers 3 add-ons:

- Payment processing solutions: Allows real-time control on internal and external payment sources.

- eFile: Offers eFile forms and payments from Sage 50.

- Checks and forms: Enables ordering custom checks and forms.

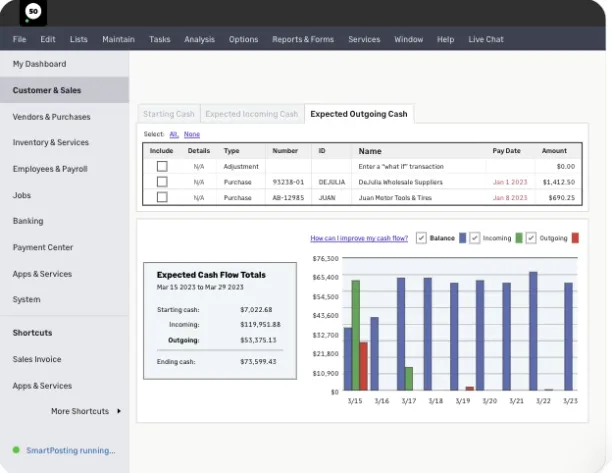

Sage Intacct

Sage Intacct is a cloud accounting and ERP solution. As the figure below suggests, Intacct is preferred by mid-market and enterprises.

Figure 3. Sage Intacct user companies size scale. Source: Gartner3

Sage Intacct emphasizes AI while explaining its features. Some AI integrated solutions include:

- Intacct can extract data from uploaded emails or AP bills and create drafts for the approval process.

- The platform identifies data regarding vendors, amount, dates, and line items.

- Intacct can detect duplicate invoices and flag them which prevents payment errors.

Intacct also offers embedded & integrated solutions. You can:

- set spending limits with Sage Intacct spend management

- automatically reconcile transactions

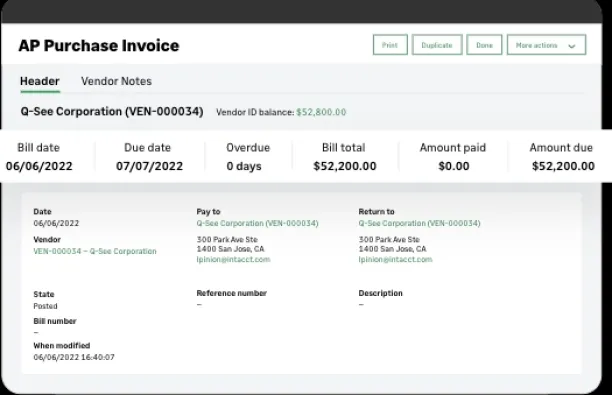

- Sage Intacct purchase order (PO) software allows you to create transaction and PO approvals and monitor procure-to-pay cycle (Figure 4).

Figure 4: Purchasing information dashboard. Source: Sage.4

Other integrations are also offered by Sage.5

Other features & capabilities

Apart from the key features mentioned above, Sage AP automation software offers additional features:

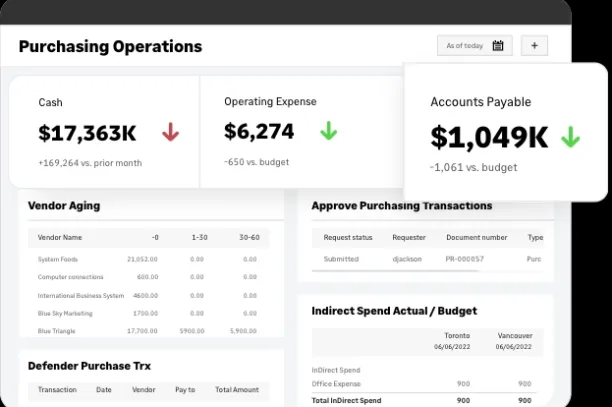

- Users can identify aged creditors and get reports on credits on a single dashboard (Figure 5).

- Users can send returns or cancel purchases. In such cases, users also can create credit notes.

- Intacct automates pulling transactions daily.

- Invoice capturing and matching in accordance with purchases and expenses is automated by the platform.

- Users can set bank rules.

Figure 5: Purchasing operations and AP dashboard. Source:6

Native integration add-ons

Sponsored: Using native integration add-ons such as Pairsoft that are built specifically to work within the existing ERP system can make AP automation process easier. With connection through APIs, you can also build a workflow between different SaaS applications with data flow in your ERP.

Apart from native add-on integration, Pairsoft further offers features to address Sage’s shortcomings, including:

- A built-in document management system

- Encrypted and integrated database for invoices and related documents

- OCR invoice capturing

- Searching features

Pros of Sage AP

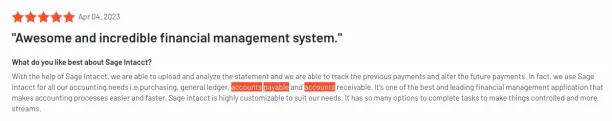

All-in-one solution: Along with other accounting processes, Sage Intacct offers automation in the entire AP process.

Figure 7: Sage Intacct review. Source:7

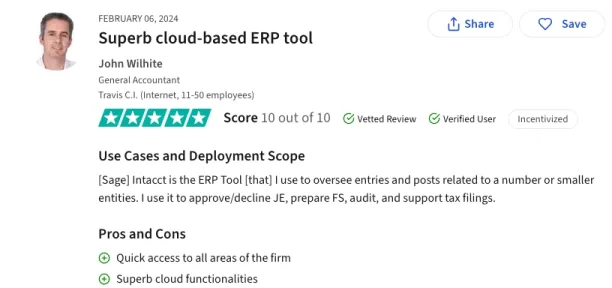

Cloud-based: 150+ users from different review platforms praised that Sage is a cloud based solution, making it accessible.

Figure 8. Sage Intacct review. Source:8

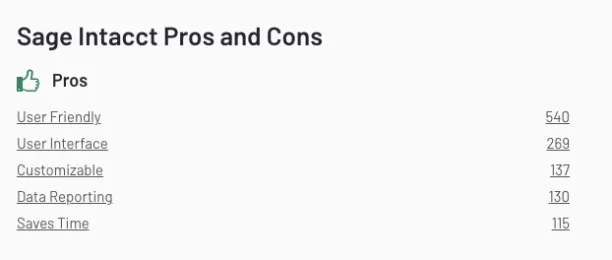

For overall pros, see Figure 9:

Figure 9. Sage Intacct overall pros. Source:9

Sage AP automation cons

Learning curve: It can be hard to navigate through Sage Intacct. 200+ users underlined that especially at the beginning the learning curve is high.10

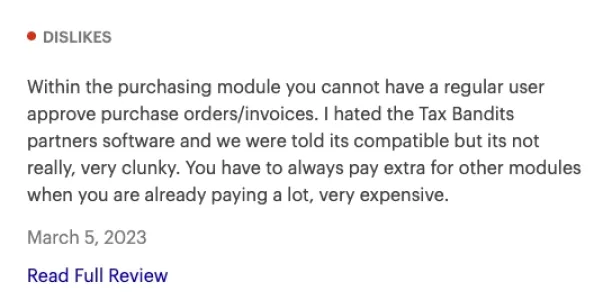

PO approval: Users criticize that in the purchasing module regular users approve purchase orders/invoices do not exist (Figure 10).

Figure 10. Sage Intacct review. Source:11

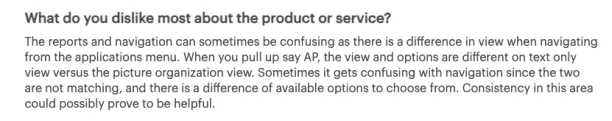

Navigation within the platform can be hard. Users point out that in some cases it can be confusing to navigate in the applications menu regarding AP (Figure 11).

Figure 11. Sage Intacct review. Source:12

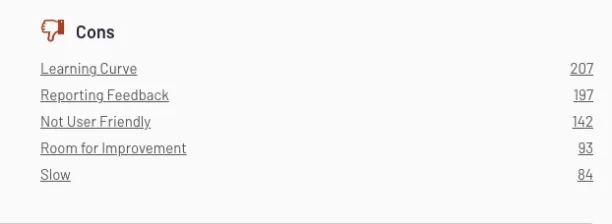

For overall cons, see Figure 12:

Figure 12: Sage Intacct overall cons 13

Pricing

Sage 50

| Package | $/month |

|---|---|

| Pro Accounting | $59/user |

| Premium Accounting | $97/user $222 for 5 users |

| Quantum Accounting | $160/user $409 for 10 users |

| Pro Accounting with Payroll | $83 for 1-10 users* $99 for 16-30 users |

| Premium Accounting with Payroll | $114** |

- *Range of employee numbers

- **With payroll bundle, premium accounting offers 15 different prices.14

Sage Intacct

With free trial, Sage Intacct offers customized pricing models. See Figure 13:

Figure 13. Sage Intacct pricing. Source:15

Analysis of top vendors

1-PaperSave by PairSoft

PairSoft’s PaperSave is a native integration tool for Sage Intacct. Papersave specifically enhances AP automation of Sage Intacct as a document capture tool in the following areas:

- Storing and capturing documents automatically cloud-based repository

- Electronic workflows to enhance bill approval processes. You can create a digital AP workflow with PaperSave

- You can relate & integrate documents with queries.

- PaperSave allows unstructured search. You can search like in a search engine since PaperSave performs a similar method by using record values & documents.

- Invoice capture in any format – including Microsoft Office documents, and slips

- PairSoft offers all-in-subscription. The subscription bundle covers support, data usage, and software usage; you avoid the need to purchase additional licenses with PairSoft when a non-Intacct user needs to access or approve an invoice.

Integration with SAGE is approved in: United States

Pros

- Workflows: 15+ users praised PairSoft’s ability to involve workflows for invoice processing & approvals.

Figure 14. PairSoft Pros. Source: G2.16

- Document management: 20 + User admired overall document management capabilities of PairSoft.

Figure 15. PairSoft Pros. Source: G2.17

- Scanning size. 15+ users provided positive feedback on PairSoft ability to adjust scanning sizes.

Figure 16. PairSoft Pros. Source: G2.18

Cons

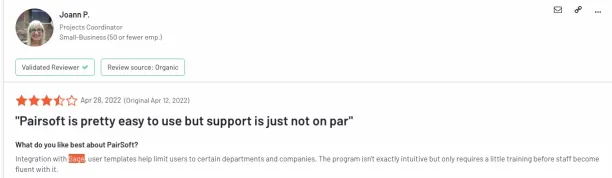

- Support: Several users pointed out the lack of support in SAGE integration.

Figure 17. PairSoft Review. Source: G2.19

2-Tipalti

Tipalti offers an end-to-end cloud-based finance automation solution for Sage.

The product extend Sage’s AP automation capabilities with features such as:

- IRS & VAT validations; W-9 / W-8 / 1099 tax compliance

- OFAC screening

- Global supplier payments

- Corporate card management

To enable the integration, Sage Intacct users are NOT required to purchase: Sage Intacct Web Services – Developer License.

Integration with SAGE is approved in: United Kingdom; United States.20

Pros

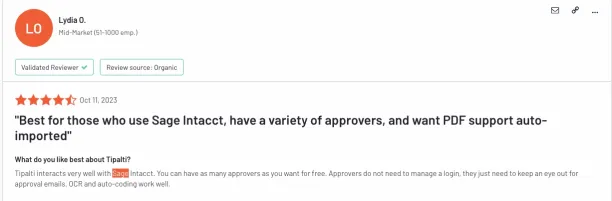

- Number of approvers: In integration with SAGE, Tipalti allows a variety of approvers (Figure 18):

- Ease of use: 50+ users pointed out the ease of use Tipalti overall offers.

Figure 18. Tipalti Review. Source: G2.21

Cons

For overall cons of Tipalti, see:

Figure 19. Tipalti overall cons. Source: G2.22

3. Stampli

Stampli natively integrates with Sage Intacct.

The prominent feature that extends SAGE’s AP automation capabilities are:

- Stampli provides a bot called Billy the Bot. This AI technology can adapt to your specific AP processes.

- ACH: Stampli enables direct ACH transfers from your bank account to your vendor. This eliminates the need to establish or fund a separate account.

- Stampli offers Stampli Card (virtual & physical). With this, from the same platform used for AP you can request, issue, and manage corporate credit cards.

Integration with SAGE is approved in: United States.23

Pros

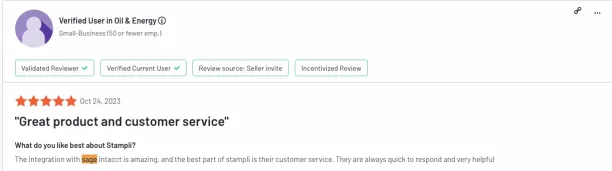

- Customer service: Users praised the customer service offered by Stampli. See Figure 20.

- Easy to deploy: 10+users highlighted that Stampli is easy to deploy in ERP integration.

Figure 20. Stampli Review. Source:24

Cons

For overall cons of Stampli, check Figure 21:

Figure 21. Stampli Overall Cons. Source: G2.25

4. Quadient Accounts Payable by Beanworks

Quadient’s features that extends SAGE AP automation solutions include:

- Quadient offers improvements in data entry through AI-driven capture of header and line item data.

- The product offers digital invoice storage. You can also search the invoices by GL code.

- Users use Quadient to extract data to gain insights on reports and spending.

Integration with SAGE is approved in: Canada; United Kingdom; United States.26

Pros

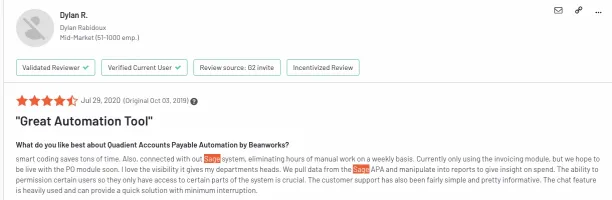

- Visibility: Users praised Beanwork’s data integration with SAGE which helps with visibility (Figure 22):

- Speed: 10+ emphasized the speed of use of Quadient.27

Figure 22. Quadient Accounts Payable by Beanworks Review. Source: G2.28

Cons

For overall cons of Beanworks, check Figure 23:

Figure 23: Overall cons of Beanworks. Source: G2.29

5. Bill

Bill can enhance SAGE’s AP automation with the following features:

- You can pay international vendors in their local currency to dodge hidden conversion fees and delays.

- Bill syncs with Intacct. This means that once payments and reconciliation is done, invoices are updated automatically with details.

- Single sign-on — provide authorized users with access via SSO services, such as G Suite (Google), Auth0, Centrify, Microsoft Azure, Okta, among others.

Integration with SAGE is approved in: United States.30

Pros

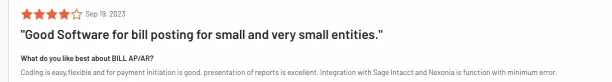

- Bill posting: Users praise Bill’s features of posting such as coding and report presentation (Figure 24)

- SSL Encryption: 64+ users highlighted Bill’s ability to encrypt SSL data.

Figure 24. Bill Review. Source:31

Cons

- Pricing: 20+ users find Bill’s pricing structure expensive.32

- Customer service: Users have complained that Bill’s customer service has been unhelpful and slow to respond.

Figure 25. Bill’s overall customer service rating in 510 reviews. Source: Capterra.33

5 things to consider when choosing solutions for SAGE AP automation

Integration: Verify that the AP automation solution integrates with your existing SAGE product. Ensure it can synchronize with Sage while supporting specific versions and functionalities.

Functionality: Examine the capabilities of the solution of automating the entire accounts payable process. Examples are:handling invoice data, executing payments, and generating reports.

User interface: Evaluate the interface of the AP automation solution. It should be easy to use, adaptable and require minimal training for your accounting teams.

Compliance: Check the security protocols of the AP automation solution, such as data encryption and access controls.

Cost and Evaluation: Analyze the pricing structure, including initial costs and ongoing fees. All-in-subscriptions are user friendly and eliminate unexpected costs.

Case studies of Sage AP automation

Benchmark

Benchmark with a workforce of 10.000+ handles its finances across more than 50 properties and 80 different units. Around 350 of its employees, including a small corporate finance team of five, managers of various departments, and staff at each property, used Sage Intacct for their financial management. At the property level, Benchmark saved about $800k annually by cutting down on manual tasks related to accounts payable. They adapted online invoice approvals, digital signatures, reduced paper use, and saved the equivalent of half a full-time employee’s work across 40 properties. This adds up to 20 full-time employees at the property level who have been shifted to more strategic roles.34

Cambio Communities

There were so many contractors involved in each project of Cambio. Thus, the financial team had to handle 100 invoices daily, or about 1500 every month. It was important to pay these contractors and suppliers quickly to keep a good working relationship with them. They also needed a system that could automatically handle all their financial tasks, including paying bills, especially since they expect to have many more community projects. Sage Intacct AP provided Cambio with a full system for managing these payments. It takes over a lot of the work that used to be done manually such as sorting invoices, paying contractors, and recording transactions. This saves the AP team a lot of time, so they can help with other important business tasks.35

Brookfield

Brookfield’s Public Securities Group changed how it handles paying bills by using Sage Intacct and American Express. This cut the time the team needed to get approvals, send checks for signing, and make payments to suppliers in half. They also managed to clear more than 100 pending invoices. With Sage Intacct, the entire accounts payable process was automated. Kyle, president of finance, explains that before, they were overwhelmed with unpaid invoices waiting to be checked and paid, often requiring the team to work extra hours. With Sage Intacct, they work much more efficiently and can quickly answer questions about payments, like how much was paid to a specific supplier last year, in five minutes instead of 30.36

Further reading

- NetSuite Accounts Payable (AP) Automation

- Blackbaud Accounts Payable (AP) Automation: In-Depth Review

- Dynamics 365 in Accounts Payable Automation: In-Depth Review

- In-Depth Guide to Accounts Payable (AP) Automation

- Accounts Payable (AP) Automation Tools Benchmarking

- 5 AI Applications in Accounts Payable (AP) Processes

- Automated Invoice Validation: Benefits & Use Cases

- Finance Automation: What It Is, Best Tools & 6 Processes

- Enterprise Invoice Processing: 4 Guidelines & 3 Solutions

- 7 Vic.AI Alternatives to Automate Accounting

- Top 10 ReadSoft Alternatives / Competitors

- Top 10 Kofax Alternatives/Competitors

- 14 Rossum AI Competitors/Alternatives

External links

- 1. “Ardent Partners’ Accounts Payable Metrics that Matter in 2023. ”Retrieved on February 15, 2024.

- 2. “Sage 50 Features”Retrieved on February 15, 2024.

- 3. “Gartner – Sage Intacct Overview”. Retrieved on February 15, 2024.

- 4. “Sage AP Core features”Retrieved on February 15, 2024.

- 5. “Sage Marketplace”Retrieved on February 15, 2024.

- 6. “Sage AP core capabilities.”Retrieved on February 15, 2024.

- 7. “Sage Review- G2”Retrieved on February 15, 2024.

- 8. “Sage Review- Trustradius”Retrieved on February 15, 2024.

- 9. “Sage Reviews- G2”Retrieved on February 15, 2024.

- 10. “Sage Intacct Review”Retrieved on February 15, 2024.

- 11. “Sage Review- Gartner”Retrieved on February 15, 2024.

- 12. “Sage Review – Gartner”Retrieved on February 15, 2024.

- 13. “Sage Reviews – G2”Retrieved on February 15, 2024.

- 14. “Sage 50 Pricing Plans”Retrieved on February 15, 2024.

- 15. “Sage Intacct Pricing”Retrieved on February 15, 2024.

- 16. “PairSoft”Retrieved on May 14, 2024.

- 17. “PairSoft”Retrieved on May 14, 2024.

- 18. “PairSoft”Retrieved on May 14, 2024.

- 19. “PairSoft Reviews 2024: Details, Pricing, & Features | G2”Retrieved on May 14, 2024.

- 20. “Tipalti”Retrieved on May 14, 2024.

- 21. “Tipalti Review”Retrieved on May 14, 2024.

- 22. “Tipalti Reviews 2024: Details, Pricing, & Features | G2”Retrieved on May 14, 2024.

- 23. “Stampli Accounts Payable Automation”Retrieved on May 14, 2024.

- 24. “Stampli G2 Review”Retrieved on May 14, 2024.

- 25. “Stampli Reviews”Retrieved on May 14, 2024.

- 26. “Quadient Accounts Payable by Beanworks”Retrieved on May 14, 2024.

- 27. “Quadient Reviews”Retrieved on May 14, 2024.

- 28. “Quadient Beanworks G2 Review”Retrieved on May 14, 2024.

- 29. “ Beanworks Reviews”Retrieved on May 14, 2024.

- 30. “Bill.com”Retrieved on May 14, 2024.

- 31. “Bill AP G2 Review”Retrieved on May 14, 2024.

- 32. “Bill Reviews”Retrieved on May 14, 2024.

- 33. “BILL Accounts Payable & Receivable Reviews 2024. Verified Reviews, Pros & Cons – Capterra”Retrieved on May 14, 2024.

- 34. “Sage success stories- Benchmark”Retrieved on February 15, 2024.

- 35. “Sage success stories- Cambio”Retrieved on February 15, 2024.

- 36. “Sage Success Story – Brookfield”Retrieved on February 15, 2024.

Comments

Your email address will not be published. All fields are required.