Mortgage Chatbots in 2024: Top Use Cases & Examples

According to McKinsey, banks with higher customer satisfaction generate deposits 85% faster than their rivals.1 One of the crucial financial procedures that has an impact on client satisfaction is loan processing. Chatbots powered by artificial intelligence (AI) can mimic mortgage brokers and automate tasks around the clock.

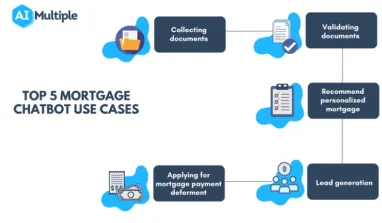

However, many executives in banking are not fully aware of the special use cases for loan chatbots. Managers frequently view chatbots as instruments for automating customer support. To close the information gap, we present 5 distinct use cases for mortgage chatbots in this paper, along with a case study. At the beginning of the article, we quickly explain their definition and significance of them as well.

What are mortgage chatbots?

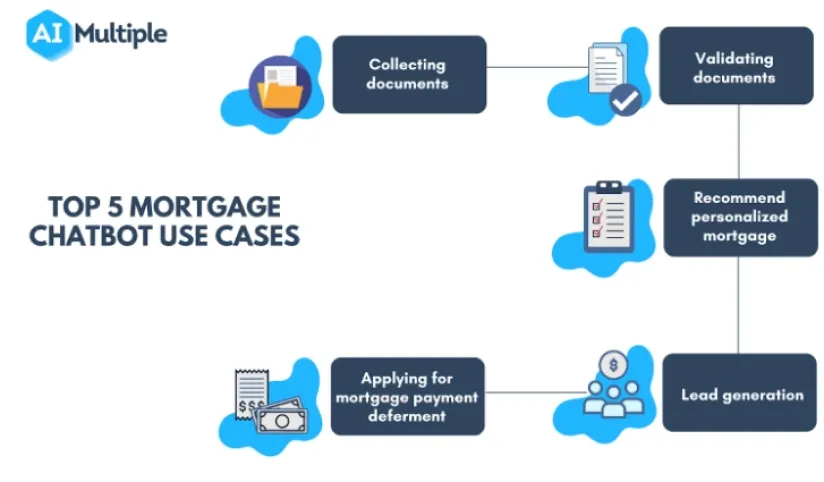

Mortgage chatbots (also referred as loan chatbots) are conversational AI systems made primarily for imitating mortgage professionals. They engage clients via text or voice communications to automate loan processing-related processes (see Figure 2). Mortgage chatbots are a subset of banking chatbots that support financial institutions’ conversational banking strategy.

It is possible to deploy loan chatbots on many platforms, such as:

- Website of the bank

- Mobile application of the bank

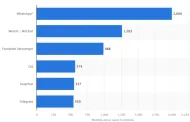

- Messaging apps like WhatsApp

- And a combination of all platforms to ensure an omnichannel customer interaction.

Figure 2: An example of interaction between a client and a mortgage chatbot.

Why are mortgage chatbots important now?

There are three major reasons why loan chatbots are important for the mortgage industry:

1. Average profit of each loan fell almost 50% in 2021

According to the Mortgage Bankers Association (MBA), banks made close to $4200 in profit on each loan in 2020. In 2021, this amount fell to 2300 dollars.3 According to the report, profits decreased especially in the second half of 2021, due to anticipation that interest rates will increase in 2022.

Through 2022, interest rates were raised by central banks all around the world, and they will stay high through 2023 and the near future.4 Because of the high rates, profitability per loan may keep decreasing or remain low for some time.

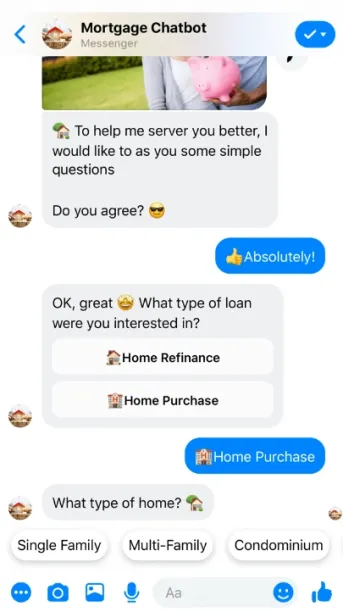

In such a scenario, for the mortgage sector to remain profitable, strategic investments must be made that lower costs. Chatbots are one of the candidate investments in this regard. For instance, Tata reduced its call center queries by almost 70% thanks to an AI chatbot (see Figure 3).

Figure 3: Tata’s chatbot engages with customers.

2. People demand digital interactions

Around 40% of customers, according to Forbes, expect completely digital engagements with financial institutions; the remaining 60% of customers prefer a mixed connection.5 According to KPMG, about 80% of banks invest in digital technologies to keep up with customer demand.6

As seen in figure 4, this digitization process has been ongoing for decades; therefore it might not be a good idea for mortgage departments to ignore it.

Figure 4: Digitalization history of the banking industry.

3. Mortgage companies can augment their workforce

Thanks to automation, mortgage specialists and customer care representatives can focus on other tasks that need special human cognition. As a result, banks are able to utilize their personnel more effectively.

These days, increasing worker productivity is not only an issue of efficiency but also a survival tactic for many businesses that struggle to attract and recruit talent due to the Great Resignation. AIMultiple views the augmentation of the workforce as one of the measures to combat the Great Resignation.

Top 5 mortgage chatbot use cases

1. Collecting documents

Finance sector is heavily regulated around the globe, and mortgage practices are not an exemption. Therefore, during a loan application, a typical mortgage company demands documents from a client that demonstrate:

- Client is a real person with a valid social security number and a tax number.

- Client has the sufficient financial ability (income/wealth) to pay the debt.

- Client acknowledges and agrees that he or she must pay specified sums of money over a specified period of time at a set interest rate, etc.

Prior to chatbot technology, customers had to physically visit offices and bring numerous paper-form documents with them, which had to be manually transferred over digital means by mortgage brokers. Therefore, neither a mortgage firm nor its clients found the method to be effective.

Nowadays, all processes can be handled on digital platforms. Financial institutions can access vital information from clients, aggregators, and third-party suppliers through chatbots, saving customers from having to carry paper copies of documents. AI-powered bots assist in the collection of documents in various formats such as:

- Images

- Pdf files

- And other forms.

Additionally, it empowers lenders to carry out compliance and auditing-related responsibilities.

The below video illustrates how loan chatbots collect client documents to ease loan issuing.

2. Validating documents

Mortgage chatbots are also useful for the mortgage industry while verifying documents. AI chatbots can analyze submitted documents as follows:

- Categorizing documents according to their information such as personal information, financial information, information regarding the reason of loan application etc.

- Thanks to natural language processing (NLP), AI chatbots extract necessary information from the documents such as the name of the consumer, their compensation, the name of the employer they work for, and so forth.

- Mortgage bots raise a red alert when there is missing information to complete a loan application process. Inconsistencies in the paperwork may also cause chatbots to stop the application process. This assists a lender in determining whether a client has submitted genuine copies of the papers needed to process their lending application. The process also automated fraud detection.

- Mortgage bots inform the client that their application procedure is over if the submitted documents satisfy all the requirements.

3. Recommend personalized mortgage or refinance policies

Determining a suitable mortgage policy is one of the tasks that mortgage brokers perform. Nowadays, chatbots can work as a:

- Mortgage calculator

- Refinance calculator,

- House affordability calculator.

to offer a suitable mortgage policy to a customer. To automate this task AI mortgage chatbots or intelligent virtual assistants collect information concerning the followings:

- What is the financial goal of the customer (e.g. reducing monthly payments)

- Income

- Mortgage balance

- Worth and location of house etc.

The below video shows how a mortgage bot works as a refinance calculator for a client:

Sponsored:

Salesforce Service Cloud Contact Center is a comprehensive customer service solution that enables organizations to manage their customer support operations and deliver good-quality customer experiences. Intelligent chatbots in the Contact Center provides personalized recommendations to the customers, automates answering customer questions and hands customers to the relevant agent.

4. Lead generation

Determining qualified leads and potential clients is another use case of AI chatbots in the mortgage industry.

Human behavior varies, thus, customers have various expectations. For instance, inexperienced buyers would be uncertain while choosing a lender. However, those with experience would be rather knowledgeable about which lender to choose. Chatbots are able to comprehend what users are saying and when a deal should be closed. This expands the potential for lead generation.

Additionally, compared to a live agent, chatbots can engage with more clients. As a result, businesses may amass more client information, which also boosts lead generation.

5. Applying for mortgage payment deferment

Customers may fail to pay their financial service providers’ charges when an external shock has a detrimental impact on the economy. Customers may request a postponement of their mortgage payments in accordance with the policies of their governments and mortgage lenders.

Financial institutions have to deal with a large number of customers at these times. Therefore, it may be necessary to automate client interactions. In such a time financial institutions can use AI chatbots to collect necessary documents from customers regarding mortgage payment deferment. AIMultiple considers such an agile strategy as an effective risk management practice since some banks used chatbots in this way during the COVID-19 pandemic.

Sparebank mortgage chatbot case study

Sparebank is a Norwegian bank that issues mortgages for customers.

Challenge

The COVID-19 epidemic had a significant influence on the Norwegian economy.7 As a result of a widespread lockdown, a falling currency,8 and significant unemployment,9 many Norwegians were justifiably concerned about the future.

As worried citizens contacted banks about the health of their finances, Norway’s banks and financial institutions experienced large increases in customer service traffic. For instance, Sparebank reached around 300 daily client queries concerning payment deferment only. Due to this situation, Sparebank was compelled to develop a scalable customer service plan.

Initiative

To deal with increased customer traffic regarding payment deferments, Sparebank improved its customer service chatbot in a way it can respond to the customers regarding this issue(see Figure 5).

Figure 5: Sparebank’s chatbot interacts with a client for mortgage payment deferment.

Result

Thanks to the initiative, Sparebank could manage excessive customer traffic concerning loan payment deferment without increasing its workload.

Note: In this article, we only focus on mortgage-related use cases. However, there are other applications of AI chatbots for financial services. To find all of them, you can read our Top 8 Chatbot Use Cases & Applications in Finance article.

If you have further questions regarding mortgage chatbots, you can reach us:

External Links

- 1. “Building the AI bank of the future“. McKinsey. May 2021.

- 2. “Mortgage Loan chatbot”. Botstar.

- 3. “IMB Production Profits Fell in 2021 from Record 2020“. MBA. April 2022.

- 4. “Inflation & Interest Rates: Cost-Of-Living Up 11.1% – Highest Increase Since 1981“. Forbes. November 2022.

- 5. “Financial Institutions Think Consumers Are All About Digital, But Customers Still Want That Human Touch“. Forbes. June 2021.

- 6. “Future of commercial banking“. KPMG. September 2022.

- 7. “UPDATE 1-Most Norway firms affected by COVID-19, slow recovery seen by many“. Reuters. April 2020.

- 8. “Norwegian Krone Collapses Amid Coronavirus Crisis“. Life in Norway, March 2020.

- 9. “Monthly unemployment rate in Norway 2020-2022“. Statista. September 2022.

- 10. “Using conversational AI to automate mortgage payment deferment for customers impacted by COVID-19“. Boost.ai.

Cem is the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per Similarweb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised enterprises on their technology decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

Sources:

AIMultiple.com Traffic Analytics, Ranking & Audience, Similarweb.

Why Microsoft, IBM, and Google Are Ramping up Efforts on AI Ethics, Business Insider.

Microsoft invests $1 billion in OpenAI to pursue artificial intelligence that’s smarter than we are, Washington Post.

Data management barriers to AI success, Deloitte.

Empowering AI Leadership: AI C-Suite Toolkit, World Economic Forum.

Science, Research and Innovation Performance of the EU, European Commission.

Public-sector digitization: The trillion-dollar challenge, McKinsey & Company.

Hypatos gets $11.8M for a deep learning approach to document processing, TechCrunch.

We got an exclusive look at the pitch deck AI startup Hypatos used to raise $11 million, Business Insider.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow on

Comments

Your email address will not be published. All fields are required.