Fintech

Top 5 Expense Management Software in 2024

Expense management is the second hardest operational cost to control. And majority of businesses don’t have a robust expense management platform in place. Emburse’s survey of 585 finance professionals shows that: If you want to scale and grow your business, you should use an expense management software to track employees expenses.

Top 13 Automation Use Cases in Private Equity in '24

With high interest rates, inflationary pressures, and a grim economic outlook, private equity firms must become agile to combat these economic devils. Automating core business processes in private equity, such as: via artificial intelligence technologies, can optimize crucial processes and improve the financial performance, transparency, and the efficiency of private equity firms.

Purchase Order Automation: How It Works & 8 Benefits in 2024

Purchase order (Figure 1) automation can speed up and streamline the purchasing process. A manual purchase order process is error-prone, time-consuming, and distracts the accounts payable team from focusing on higher value tasks. For instance, a telecom company had a procurement duration of 45 business days vs. the industry average of 25.

Payment Automation: How It Works & Its 6 Benefits in 2024

Payment automation is a function within the accounts payable process. With more individuals and entities embracing electronic payments, payment automation systems can: In this article, we will explain what payment automation is, the challenges of manual payment processing, and the benefits of payment automation.

Mortgage Chatbots in 2024: Top Use Cases & Examples

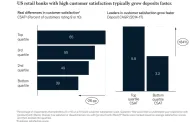

According to McKinsey, banks with higher customer satisfaction generate deposits 85% faster than their rivals. One of the crucial financial procedures that has an impact on client satisfaction is loan processing. Chatbots powered by artificial intelligence (AI) can mimic mortgage brokers and automate tasks around the clock.

Top 5 Use Cases of Wealth Management Chatbots in 2024

Wealth management chatbots are computer-based software agents that are beneficial for financial institutions in many ways, including: They are driven by machine learning (ML) algorithms such as advanced analytics and conversational artificial intelligence (AI) that understand user intent and respond to it.

Conversational Banking: Everything You Need to Know in 2024

According to McKinsey, when compared to their competitors, banks with higher customer satisfaction grow deposits 85% more quickly. Therefore, to ensure customer satisfaction, almost 80% of banks invest in digital technologies. However, 45% of bank executives consider their customer-centric banking experience as insufficient, according to KPMG.

Top 5 Expectations in the Future of Finance in '24

In this article, we explain our top five financial industry expectations, such as the widespread use of workload automation tools, AI, and blockchain technology.

Use Automation for 6 Steps of Loan Processing Procedure in '24

The average loan processing procedure takes 52 days to complete. The end to end procedure consists of roughly six steps: Whether from the borrower’s side or from the lender’s, manual completion of these steps can slow down the loans’ processing time, contribute to errors, and needlessly take up everyone’s time.

Top 7 Benefits of Expense Management Automation in 2024

Controlling expenses is the second most difficult cost to manage. And many businesses still rely on manual expense management. A survey of ~ 600 finance managers has shown that across small, mid-size, and large businesses, an average of 41% still rely on manual expense management (Figure 1).