Top 5 Use Cases of Wealth Management Chatbots in 2024

Wealth management chatbots are computer-based software agents that are beneficial for financial institutions in many ways, including:

- Automation of tedious tasks

- Engaging with customers

- Decreasing operational overheads.

They are driven by machine learning (ML) algorithms such as advanced analytics and conversational artificial intelligence (AI) that understand user intent and respond to it.

Although some pioneers use wealth management chatbots, many wealth managers are not aware of them. Therefore in this article, we introduce the top 5 wealth management chatbot use cases with real-life success stories.

1. Customer onboarding

Client onboarding is a repeated but important task for financial services sector players. For some institutions, thousands of people are on-boarded each month. Chatbots can:

- Collect and verify necessary documents for onboarding.

- Introduce the firm’s portal and capabilities to customers.

- Show how to transfer money from one account to another.

- Show how to buy and sell stocks or other financial instruments and so on.

This process can be streamlined by finance chatbots.

Sponsored:

Salesforce is the CRM market leader and Salesforce Contact Genie enables multi-channel live chat supported by AI-driven assistants. Salesforce Contact Center enables workflow automation for many branches of the CRM and especially for the customer service operations by leveraging chatbot and conversational AI technologies for a personalized customer experience.

2. Financial advisory

Wealth management chatbots or intelligent virtual assistants (IVAs) can provide investment advice on digital platforms such as:

- Messaging platforms like WhatsApp

- Mobile applications of security, wealth management, or mutual fund companies

- Websites of financial institutions.

Chatbots can handle this task in two main ways:

1. Rule-based advisory

Customers can subscribe to weekly/monthly newsletters of wealth management institutions or ask chatbots about the recent expectations concerning stocks. Then chatbots send the financial reports to certain customers as mass messages.

2. Two-way communication-driven advisory

Another way of providing financial consulting for clients is mimicking offline financial advisors with chatbots. When clients demand financial advice, consultants survey them to understand:

- Client’s risk attitude.

- Client’s financial expectations.

- Duration of investment etc.

Subject to this information, financial consultants create a suitable portfolio for clients. Thanks to advancements in NLP, NLU, and ML capabilities nowadays chatbots can mimic these activities and provide an online two-way communication-driven financial consultancy.

3. Financial education

Customer engagement is a valuable factor for wealth management businesses like all other companies. One of the engagement strategies for finance companies is increasing their clients’ financial literacy to help them to make better investment decisions.

4. Personalized notifications

Personalized notifications can be automatically sent via finance chatbots. Sending tailored notifications improves the general marketing practices of companies. According to PwC, personalized customer notifications improve trust and brand engagement.1

Chatbots can send notifications regarding the followings:

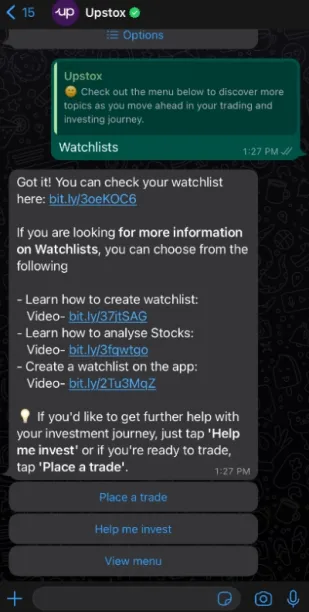

- Watchlists: Customers create watchlists for certain stocks. Thus when the price of the stock reaches a certain level, it alerts clients (see Figure 4).

- Two-factor authentication messages: Automated two-factor authentication messages reduce the probability of fraud. Thus, they can enhance client trust.

- Transaction details: Customers might prefer to reach transaction details to collect them as proof of transactions.

Figure 1: An example of creating a watchlist via chatbot.

5. Customer service automation

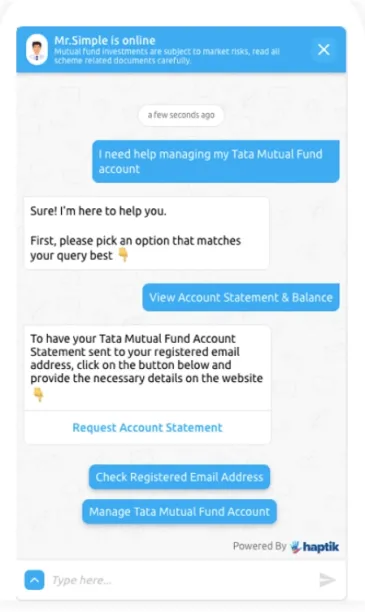

Chatbots are effective tools for automating customer services. They can answer frequently asked questions (FAQs) and more complicated customer queries (see Figure 2).

Figure 2: Chatbot answers FAQs.

Main advantages of automating customer interactions via chatbots are:

- Augment workforce: Automated customer engagement implies that customer service representatives can allocate their time for more added value tasks. For instance, human assistance creates more value for financial organizations when people design new financial instruments/solutions that improve a client’s financial situation.

- Reduce costs: For some cases, chatbots provide up to 90% end-to-end query resolution and reduce call center traffic up to 65%. Therefore, financial institutions can significantly reduce their variable costs.

- Provide 7/24 customer support: Chatbots or IVAs do not need to take vacations, get sick or tired. They can simultaneously engage with many customers. Thus, they support customer service around the clock.

- Multilingual: Wealth management chatbots can understand and respond in many languages. Thus, customers can pick the language they feel comfortable with.

Note: Chatbots can fail due to a variety of reasons; therefore, human agent takeover is an important capability managers should keep in mind while implementing conversational AI solutions.

Further readings regarding conversational AI vendors

If you want to have a wealth management chatbot but do not find a suitable conversational AI vendor you can read our following articles:

- 50+ Chatbot Companies To Deploy Conversational AI.

- Conversational Banking: Everything You Need to Know in 2023.

- WhatsApp Business Partners: Everything You Need to Know.

- Conversational Commerce Platforms: Data-driven Benchmarking.

We would like to answer your further questions regarding finance-specific chatbots:

External Links

- 1. “Experience is everything. Get it right.”. PwC.

Cem is the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per Similarweb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised enterprises on their technology decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

Sources:

AIMultiple.com Traffic Analytics, Ranking & Audience, Similarweb.

Why Microsoft, IBM, and Google Are Ramping up Efforts on AI Ethics, Business Insider.

Microsoft invests $1 billion in OpenAI to pursue artificial intelligence that’s smarter than we are, Washington Post.

Data management barriers to AI success, Deloitte.

Empowering AI Leadership: AI C-Suite Toolkit, World Economic Forum.

Science, Research and Innovation Performance of the EU, European Commission.

Public-sector digitization: The trillion-dollar challenge, McKinsey & Company.

Hypatos gets $11.8M for a deep learning approach to document processing, TechCrunch.

We got an exclusive look at the pitch deck AI startup Hypatos used to raise $11 million, Business Insider.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow onNext to Read

Top 5 Tools for Customer Engagement Automation in 2024

Chatbot Pricing: How Much Different Chatbots Cost in 2024?

Sales Chatbots in 2024: Top Use Cases & Best Practices

I’ve been on the hunt for a comprehensive Financial literacy platform, and it looks like I’ve found the perfect one! It’s so important to be financially savvy in today’s world, and this platform seems like the ideal place to start. Thanks for making this valuable resource available!

Comments

Your email address will not be published. All fields are required.