In-Depth Guide into UX Survey in 2024

UX surveys are the most intuitive way to gather feedback from customers and understand how your brand, products, or services are seen by your target audience. Yet, few companies conduct user research surveys, as a study shows companies hear only from 4% of their dissatisfied customers.

Here, we present the best practices for conducting UX surveys, the most popular survey tools, some commonly used survey types, and some real-life survey question examples from reputable brands.

7 best practices of UX surveys

Before creating UX surveys, it’s crucial to identify the target customers to tailor questions and gather relevant insights effectively. Defining the goals of the survey helps align the questions with the desired outcomes, ensuring meaningful data collection for informed design decisions.

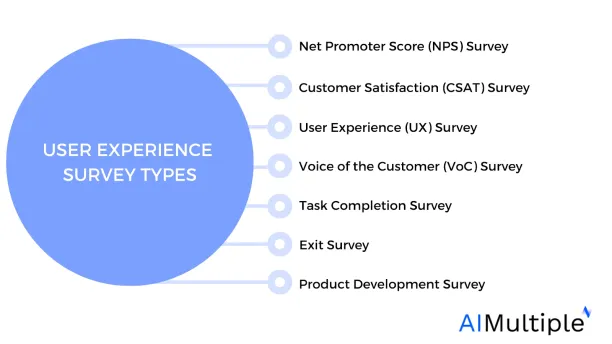

1- Determine the survey type

The first step of UX research surveys is to determine the survey design. When determining the type of UX survey to conduct, it’s important to consider the specific goals and context of your research. Here are some common types of user experience surveys and their applications:

1.1. Net Promoter Score (NPS) Survey

NPS surveys are used to measure customer loyalty and the likelihood of customers recommending your product or service to others. They typically ask one key question: “How likely are you to recommend our [product/service] to a friend or colleague?” Respondents are usually asked to rate on a scale from 0 to 10. NPS surveys are great for getting a high-level view of customer satisfaction and loyalty.

1.2. Customer Satisfaction (CSAT) Survey

Customer satisfaction surveys measure how satisfied customers are with your product or service. Questions often revolve around specific interactions, products, or experiences. For example, “How satisfied were you with your recent experience with our customer service team?” These surveys are useful for assessing satisfaction with specific aspects of your product or service.

1.3. User Experience (UX) Survey

UX surveys focus on how users interact with your product. They can cover a range of topics, including usability, design, and overall experience. Questions might include “How easy was it to navigate our website?” or “How visually appealing do you find our app interface?” These surveys are valuable for identifying specific areas for improvement in the user interface and overall user experience.

1.4. Voice of the Customer (VoC) Survey

VoC surveys are comprehensive and aim to capture the customer’s overall experience with your brand. They often include open-ended questions to allow customers to provide detailed feedback. VoC surveys can encompass elements of NPS, CSAT, and UX surveys but with a broader focus on the customer’s total experience and perception of the brand.

1.5. Task Completion Survey

These surveys are presented to users after they complete a specific task, like making a purchase or finding information. They usually ask about the ease of completing the task, any difficulties faced, and overall satisfaction with the process.

1.6. Exit Survey

Exit surveys are given to users as they are leaving your website or app. They often ask why the user is leaving, whether they accomplished what they intended to, and what could be improved.

1.7. Product Development Survey

These surveys are used during the product development phase to gather feedback on new concepts, prototypes, or beta versions of a product. They help in understanding user expectations and preferences in the early stages of product design.

To learn more about product market research, check out our detailed article.

2- Ask simple and targeted questions

User attention spans are limited. Design your survey to be concise, focusing on key questions that directly relate to your objectives. Besides, aim for a survey that can be completed in a few minutes.

Check out the best practices to conduct online surveys.

3- Use a mix of question types

A combination of closed-ended (like multiple-choice or Likert scale questions) and open-ended questions can provide a balance of quantitative and qualitative data. You can also use AI-driven text analysis tools to analyze open-ended responses to understand customer sentiment.

4- Ask visual or video-embedded questions

Incorporating multimedia elements like images or videos can make your survey more engaging and can provide a richer context for questions. For example, showing a user interface element and asking for feedback on it. Visual questions can often be more intuitive and yield more precise responses than text-only questions.

5- Conduct pilots before launching your survey

Pilot testing is crucial. It helps identify any issues with the survey’s flow, question clarity, or technical glitches. A small group of participants similar to your target audience can provide feedback on the survey experience. This step ensures that the survey is optimized for the best response rate and quality of data before full deployment. You can also leverage ChatGPT to evaluate the quality of your questions and for suggestions that can be added in the surveys.

To learn more about the use cases of ChatGPT in survey research, check out our detailed article.

6- Recruit participants for surveys

Recruiting the right participants is key to obtaining valuable insights. Define your target audience clearly and use various channels like email lists, social media, or participant recruitment platforms to reach them. Ensure that the participant pool is diverse and representative of your entire user base.

If you are looking for a participant recruitment tool, check out our vendors’ guide.

7- Get help from AI-driven survey analysis tools

After collecting survey responses, leverage AI-driven tools for efficient and in-depth analysis, especially for qualitative insights. These tools can provide actionable insights as they can handle large volumes of data, identify trends, perform sentiment analysis, and even predict user behavior based on responses. They are particularly useful for interpreting open-ended questions, where manual analysis can be time-consuming and subjective.

If you are looking for a survey analysis tool, here is our comprehensive benchmark on the available solutions in the market.

UX survey tools

There are various survey tools in the market which can be used for creating UX surveys. Here we list some of the most popular survey tools:

2- SurveyMonkey

3- Qualtrics

4- Pollfish

5- Zoho Survey

User experience (UX) survey question types

Below is a table that outlines the most commonly used UX survey questions, each with a brief description and an example to illustrate how they might be used:

| Question Type | Description | Example |

|---|---|---|

| Multiple Choice | Predefined answers for respondents to choose from. | Which feature do you use the most? |

| Likert Scale | Scale for rating agreement or satisfaction (e.g., 1-5). | How satisfied are you with our app? |

| Open-Ended | Respondents answer in their own words. | What improvements do you suggest? |

| Binary (Yes/No) | Simple binary choice questions. | Did you find the website easy to use? |

| Ranking | Respondents rank options in order of preference. | Rank these features by your preference. |

| Checkboxes | Questions that allow multiple selections from a list of options. | Which of these features do you use? |

Examples of effective user experience survey questions

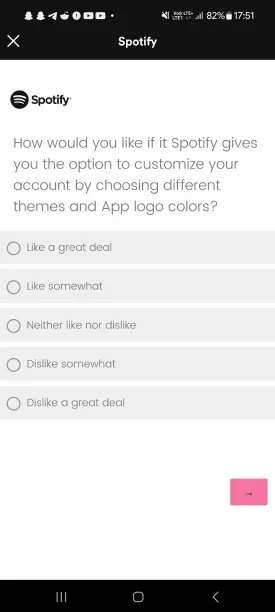

1 – Likert scale

You can give your customers a scenario and ask to rate how they would respond to it from 1 (strongly dislike) to 5 (strongly like) (see figure below).

Figure 2. Spotify survey question example

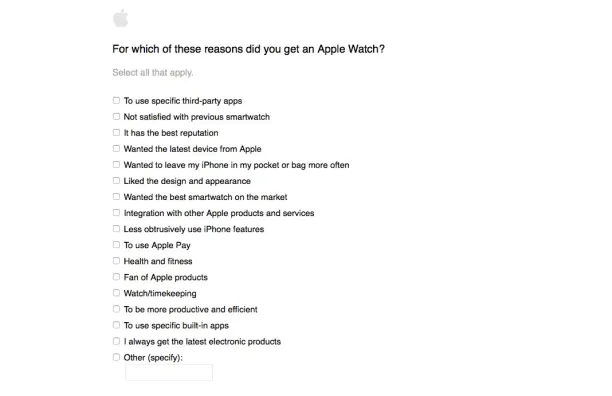

2- Checkboxes

You can use checkboxes to understand the underlying reasons for selectingto select a product or a service (see figure below).

Figure 3. Apple customer survey question example

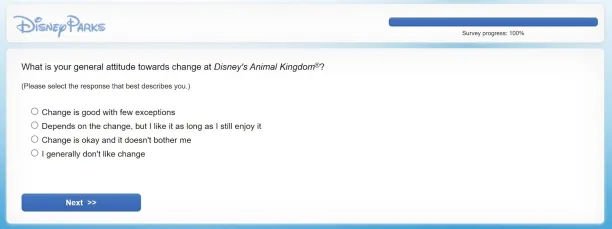

3- Multiple choice

Ask your customers to choose an option regarding their general attitude towards any changes made in a product or a service (see figure below).

Figure 4. Disney customer satisfaction survey example

For those interested, here is our data-driven list of survey software.

For those interested, here is also our data driven list of market research tools.

If you need help, contact us:

Cem is the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per Similarweb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised enterprises on their technology decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

Sources:

AIMultiple.com Traffic Analytics, Ranking & Audience, Similarweb.

Why Microsoft, IBM, and Google Are Ramping up Efforts on AI Ethics, Business Insider.

Microsoft invests $1 billion in OpenAI to pursue artificial intelligence that’s smarter than we are, Washington Post.

Data management barriers to AI success, Deloitte.

Empowering AI Leadership: AI C-Suite Toolkit, World Economic Forum.

Science, Research and Innovation Performance of the EU, European Commission.

Public-sector digitization: The trillion-dollar challenge, McKinsey & Company.

Hypatos gets $11.8M for a deep learning approach to document processing, TechCrunch.

We got an exclusive look at the pitch deck AI startup Hypatos used to raise $11 million, Business Insider.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow on

Comments

Your email address will not be published. All fields are required.